Industry Outlook for the Insurance Market (Q4 2023)

Thus, risk-free interest rates continue to point to a favorable environment for the Life savings business, improving the outlook for products with longer durations, such as life annuities, due to the rise in interest rates in the longer maturity tranches. However, the inversion of the curve for shorter terms (in which the term premium is negative) also favors the development of products with shorter durations and periodic renewals. Meanwhile, the correction in the Euro Stoxx 50 and other international indexes, along with the drop in fixed-income value, is paving the way for the development of Life insurance products in which the policyholder assumes the investment risk. This will make it possible to expand the composition of the reference assets, giving more weight to fixed income after the sharp corrections in the bond market in 2022 and so far this year.

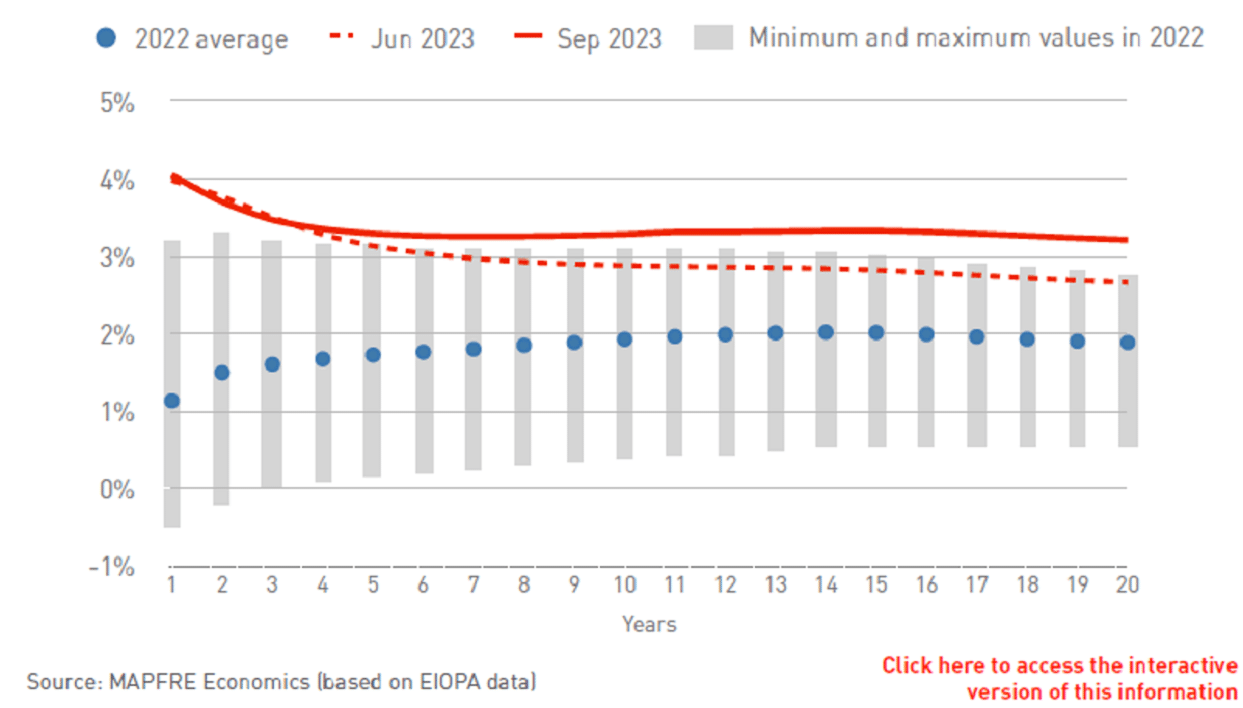

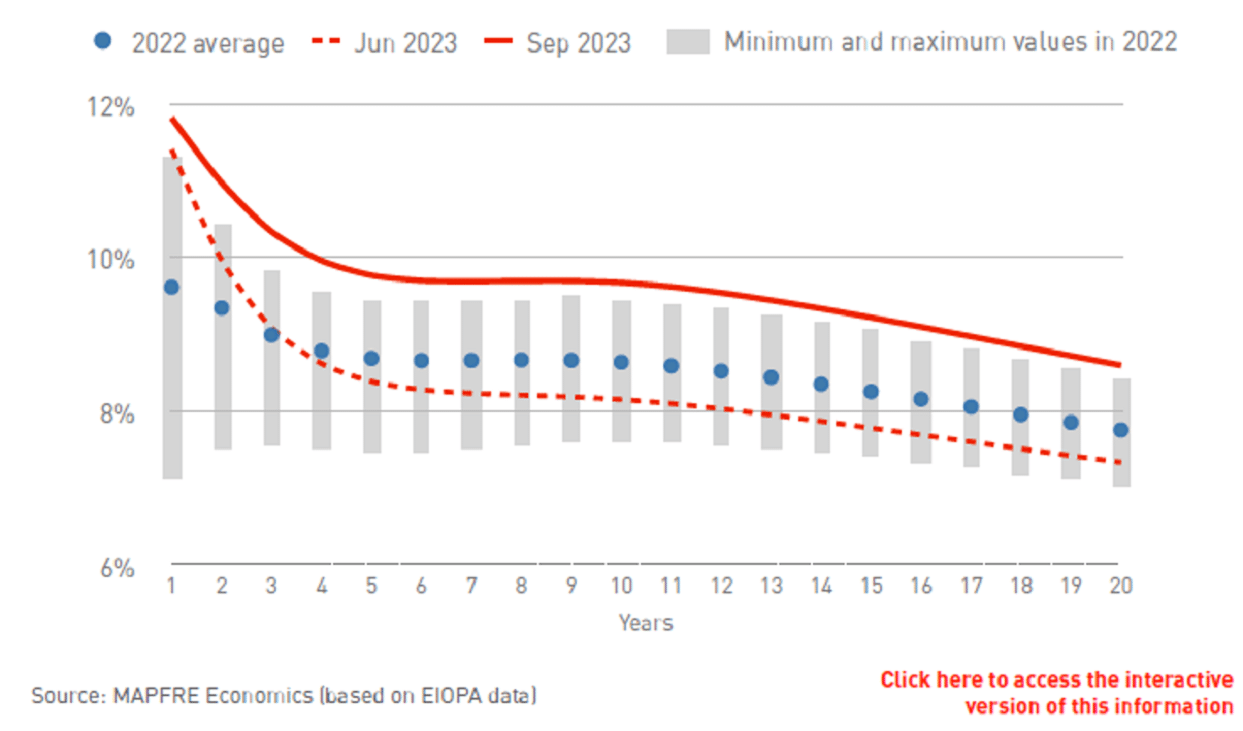

In the United States, the Federal Reserve has held its monetary policy rates within a 5.25% to 5.5% range since July and decided to keep them at this level at its last meeting. Therefore, it is maintaining a restrictive monetary policy until it sees clear signs of inflation coming under control and approaching its 2% target. While the data continues to improve, it remains far away from its objective, and the economy remains stronger than expected. In the EIOPA risk-free yield curve for the market in September (see Chart 2), an increase in levels is observed in every tranche of the curve, which become more significant as maturities increase. The curve flattens slightly, but maintains a negative slope while offering positive real interest rates (above the latest inflation data) in every tranche. This suggests a highly favorable environment for the sale of Life savings insurance products with guaranteed short-term rates and rate revisions at each renewal, while products with longer-term interest rate guarantees and life annuities are also gaining appeal.

Meanwhile, after gaining 15.5% until June, the S&P 500 has fallen into correction in recent months, placing its annual gain at 6.9% on October 30. As for the Nasdaq Composite, after rising 30.5% until the end of June, it has trended downward in recent months, and the annual gain stood at 19.7% as of the same date. The latest corrections and increased volatility are introducing some uncertainty that may affect the development of Life insurance products in which the policyholder assumes the investment risk. In particular, it could impact the composition of their assets, with fixed income gaining weight in the product mix offered in the market, considering the high returns currently offered by fixed-income assets in the U.S. market.

In the emerging markets, the Brazilian economy continues to exceed expectations, and the country’s GDP growth forecast for 2023 has therefore been revised. However, growth should slow down over the next year as tighter financial conditions impact the real economy, despite the latest cuts in the reference interest rates. In this context, the insurance market continues to perform well, especially in the Non-Life segment, with growth exceeding inflation in nearly all lines of business, although it should be reduced in line with the anticipated economic slowdown. Meanwhile, profitability indicators remain strong, driven by easing inflation and significantly higher financial income due to high interest rates that far exceed the current inflation rate.

The Central Bank of Brazil, which started to raise interest rates a year before the Federal Reserve, began to reduce its monetary policy rates in July. It announced three decreases of 50 bps each in July, September, and October, placing them at 12.25% in response to the improvement in inflation data.

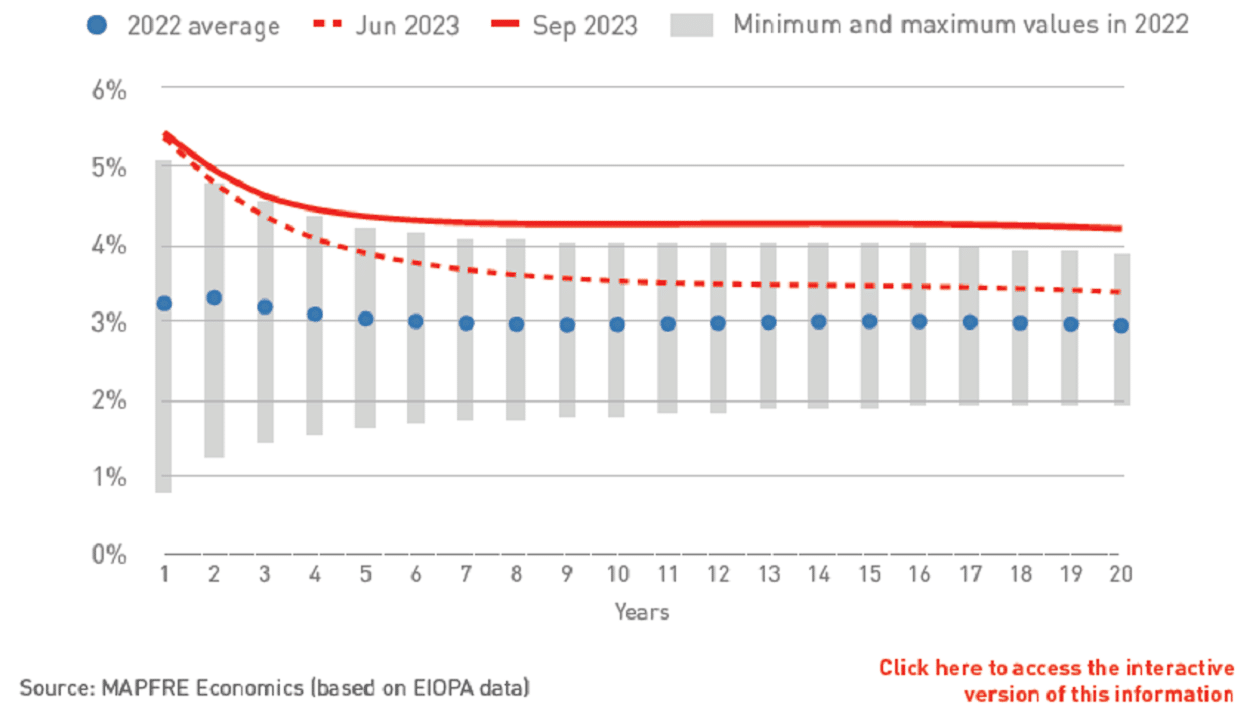

Chart 3. Brazil: risk-free yield curve

(%)

The EIOPA risk-free yield curves at the end of September (see Chart 3) show a decline in the shortest tranche of the curve and a rise in other maturities, with a positive term premium and real interest rates, especially in maturities of around 10 years. This continues to provide a highly favorable environment for the development of the Life savings business (VGBL and PGBL) and life annuities, with interest rates that still offer returns that far exceed the latest inflation data. However, the predicted economic slowdown could lead to weaker growth for this line of business over the coming quarters.

In Mexico, as in Brazil, the economic growth forecast has been revised upward, while a slowdown is anticipated for 2024 in an economy that is withstanding the tightening of financial conditions better than anticipated. Interest rates are high (11.25%), and inflation continues to ease (4.45% and 4.26% in September and October, respectively), surpassing but moving closer to the target range (from 2% to 4%), although core inflation remains stubbornly high. Against this economic backdrop, and amid tightened financial conditions, the insurance market could experience a downturn, especially in the Non-Life segment. At the same time, more moderation in price increases and the high returns of investment portfolios are helping to boost the industry’s profitability, which remains affected by the steep rise in inflation over the past two years.

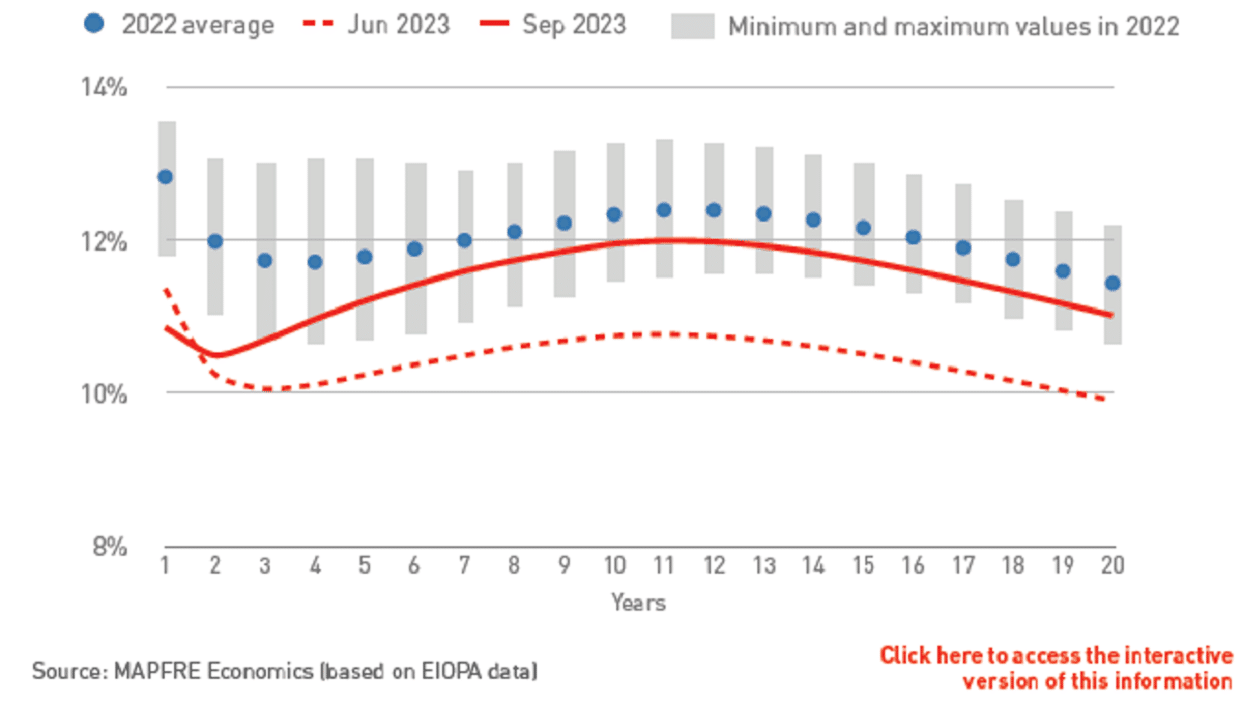

Chart 4. Mexico: risk-free yield curve

(%)

Regarding the interest rate environment, the Bank of Mexico has held the reference monetary policy interest rate at 11.25% since March. In the risk-free yield curves produced by EIOPA (see Chart 4), an increase is noticeable at all tranches of the curve, which remains significantly inverted in its tranches up to five years and flat in its middle tranche. This interest-rate environment remains suitable for the development of Life savings insurance, with positive real interest rates that could offer significantly higher remuneration than the latest inflation data. The rise in the risk-free yield curve above the highs of the previous year suggests a favorable scenario for the launch of savings products with shorter-term guarantees and periodic revisions of guaranteed rates. Additionally, products with longer terms and life annuities would gain appeal due to the high interest rates offered along all tranches of the curve.

In Spain, the economic growth forecast has been revised upward for 2023, to 2.5% (5.8% in 2022), and downward for 2024, when growth is expected to slow to 1.3% in a context of tighter financial conditions and greater uncertainty from the conflict in the Middle East and war in Ukraine. The Spanish insurance industry continues to experience considerable growth, although it could face a slowdown that would especially impact the most cyclical businesses linked to credit behavior. However, growth would remain significant in Life savings and annuities, with gradual improvement in the profitability outlook due to easing inflation, the adjustment of premiums as policies are renewed, and higher financial income.

Full analysis of the economic and industry perspectives, with additional information and interactive charts on the Eurozone, Germany, Italy, Spain, United Kingdom, United States, Brazil, Mexico, Argentina, Turkey, Japan, China, and the Philippines, can be found in the report entitled Economic and Industry Outlook 2023: Fourth-Quarter Perspectives , prepared by MAPFRE Economics and available at the following link: