The Spanish insurance market in 2020

Author: MAPFRE Economics

Summary of the report’s conclusions:

MAPFRE Economics

The Spanish insurance market in 2020

Madrid, Fundación MAPFRE, July 2021

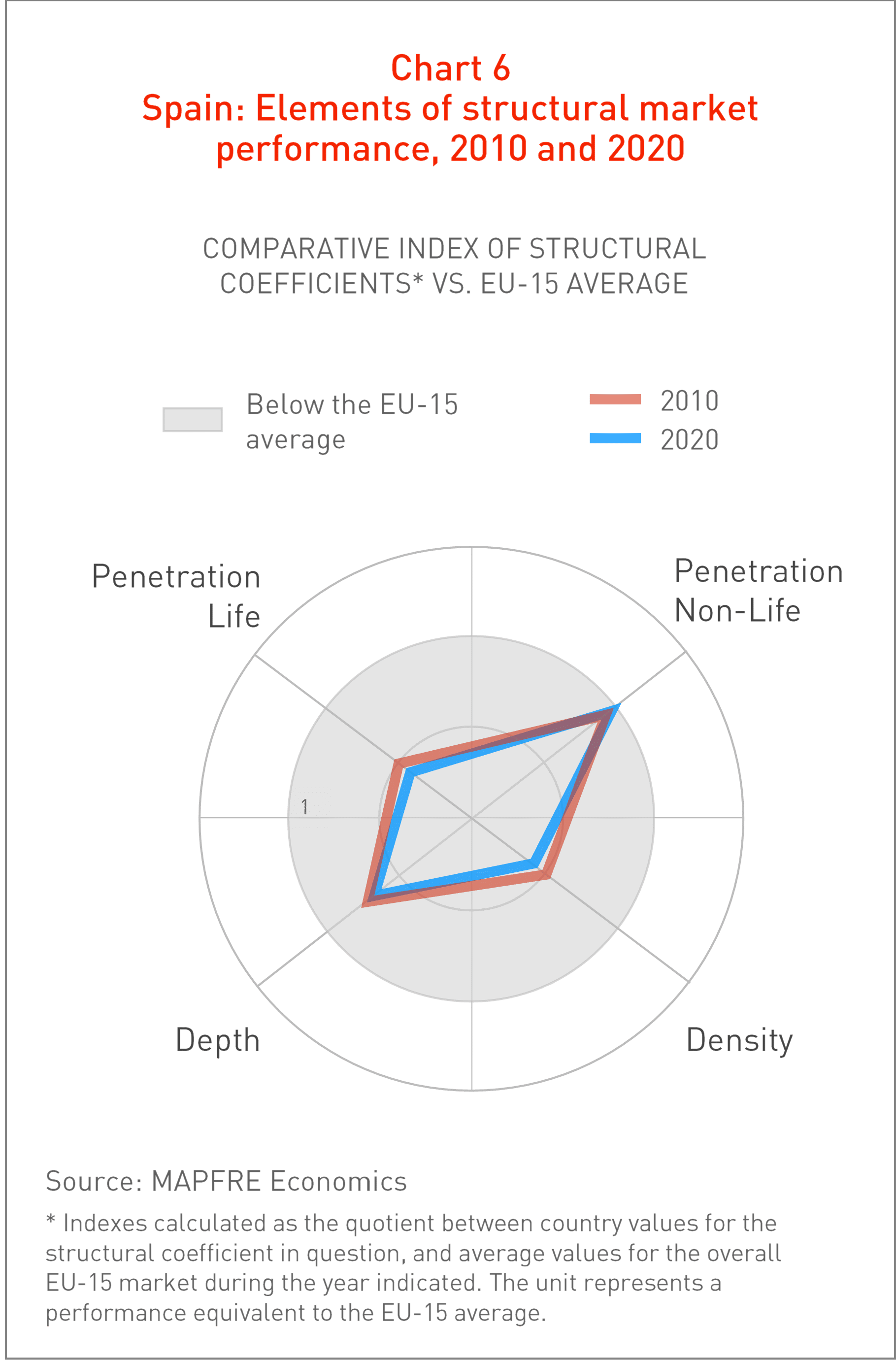

The Spanish insurance industry remains immersed in an environment marked by the partial recovery of the national economy after the sharp contraction in GDP, which fell 10.8% in 2020. In Spain, the aggregate volume of insurance premiums in 2020 amounted to 58.89 billion euros, which represented an 8.2% decrease in business due to the steep decline in the Life segment, the most affected by the crisis (see Chart 1).

2021 Outlook

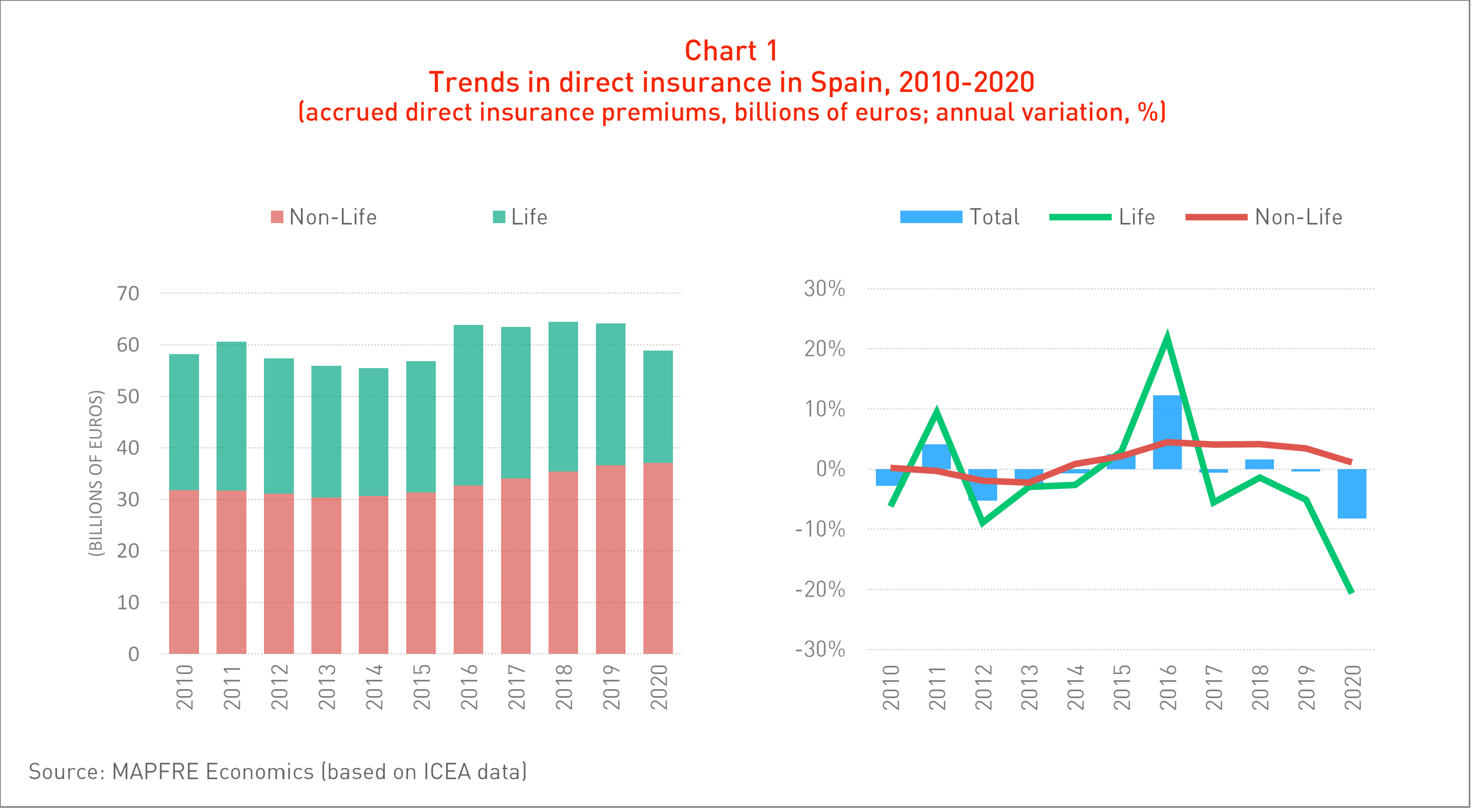

Analyzing a series that includes the first ten months of 2021, it can be observed in the Non-Life insurance segment that Auto insurance remains one of the areas most impacted by the economic crisis. It is also affected by exogenous factors that are reducing new registrations (see Chart 2), such as the chip shortage for new vehicle manufacture and increased tax pressure.

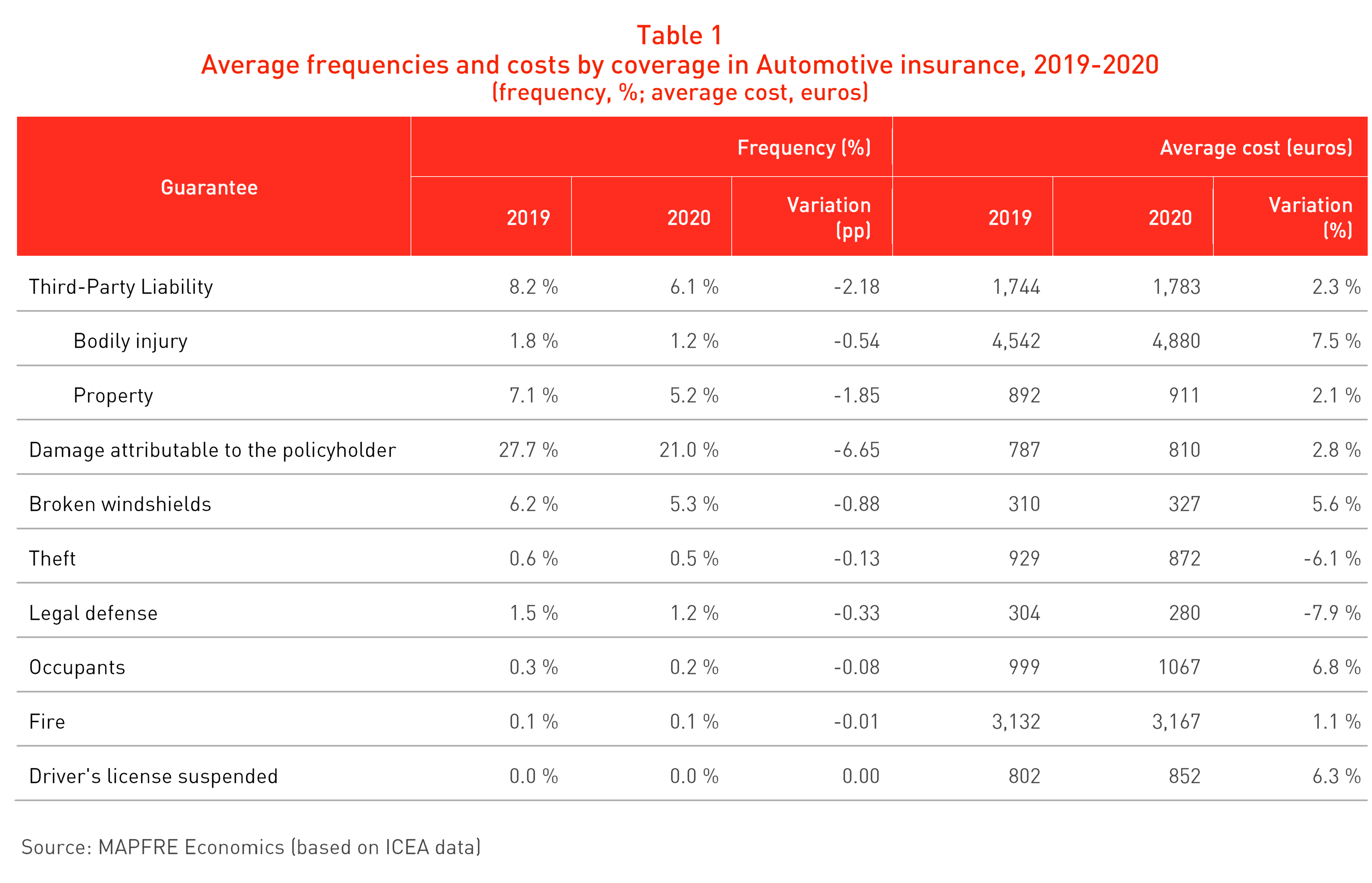

However, from the profitability perspective, it was a good year for this line of business. The combined ratio in Auto insurance improved significantly by 6.9 pp in 2020 (standing at 87.8%), a result of the exceptional situation caused by the lockdown measures implemented to address the COVID-19 pandemic. This caused consumers to use their vehicles less, resulting in a decrease in accident frequency (see Table 1). This situation started to normalize with the reopening process, putting the combined ratio above 90% in the first half of the year 2021.

Health insurance, on the other hand, continues to show great resistance, with a 5.1% year-on-year increase in premiums in the first ten months of 2021 (5.1% in 2020 as a whole), helped by the collapse in the public health system in the worst moments of the pandemic. The percentages of insured population are increasing in all autonomous regions, but there has been a marked increase in health spending. This is due to the fact that many insured parties delayed non-urgent healthcare, and there is every indication that the combined ratio may increase significantly this year compared to 2020.

It is also noteworthy that business volume remained strong amid the crisis in multi-risk insurance, which continues to show remarkable growth (especially for industrial and home insurance). Data published for the first ten months of 2021 shows a 5.1% year-on-year increase (+8.2% compared to the same period in 2019). The growth was particularly strong in industrial multi-risk, which rose 8.1% (+14.2% compared to the same period of 2019).

Total premium volume in Life insurance reached 21.84 billion euros in 2020, a 20.7% decrease from the previous year. The declines affected the Savings business (-25%) to a far greater extent than the Risk business (-0.4%), reflecting the strongly negative impact of the economic crisis and the persistence of an environment where interest rates are low. Unit-linked products (in which the policyholder assumes investment risk) were an exception, growing 1.1%. Long-term care products also performed positively, with a 17.9% increase, although premium volume remains reduced in both cases. In terms of managed savings, technical provisions decreased by 0.3%, breaking the trend of more than a decade of growth and standing at 194.11 billion euros.

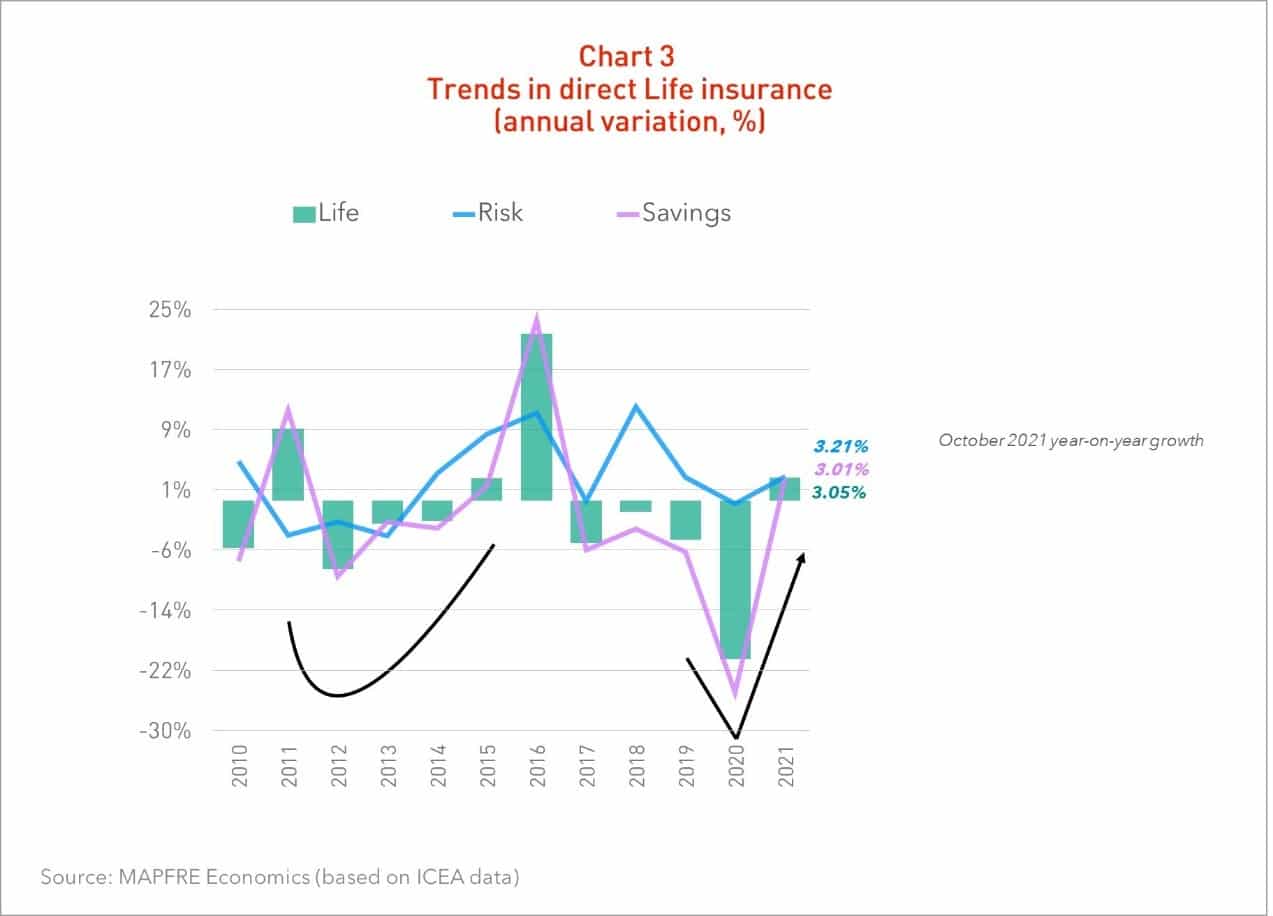

The most recent data for the first ten months of 2021 shows some recovery in Life insurance growth, with a 3.1% year-on-year increase in premiums, with Life risk insurance growing 3.2% and Life insurance savings up 3% (see Chart 3).

However, in terms of Life insurance savings growth, the base effect is considerable, and this area shows a 28.2% decrease compared to the same period of 2019 (this is not the case of Life risk insurance, which grew 3.45%). Risk insurance performance is closely associated with the recovery of private consumption and credit performance, as this type of insurance is largely linked to loan performance. On the other hand, the low-interest-rate environment continues to encourage savers to seek greater returns in exchange for higher risk, opting for alternatives for their savings, such as unit-linked products.

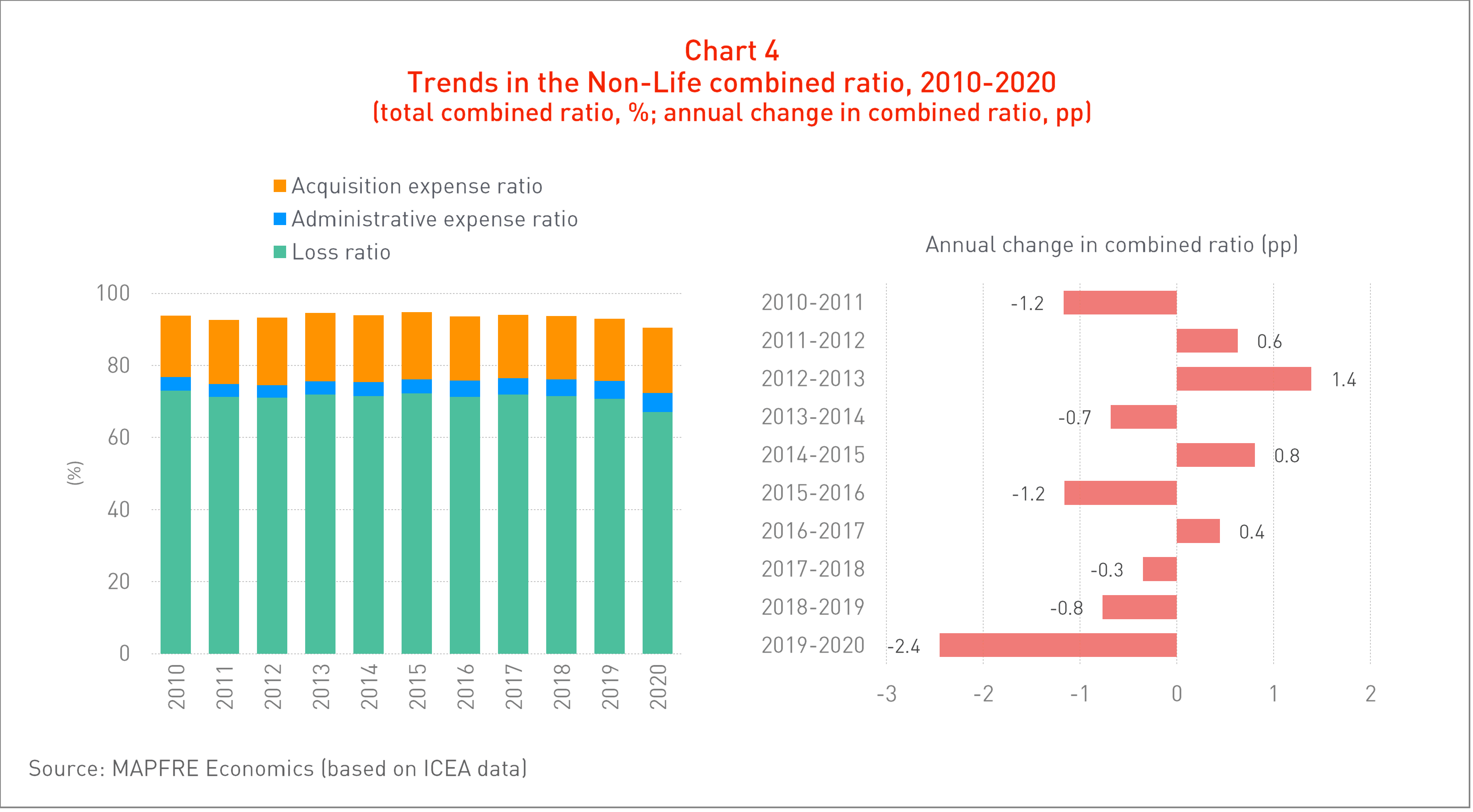

Regarding profitability, the combined ratio for the Non-Life insurance segment during 2020 was 90.5% (versus 92.9% the previous year) due to an improved loss ratio of -3.6 pp at 67%. However, the administrative expense ratio was 5.3% (losing 0.3 pp), while the acquisition expense ratio was 18.1%, growing by 0.9 pp (see Chart 4).

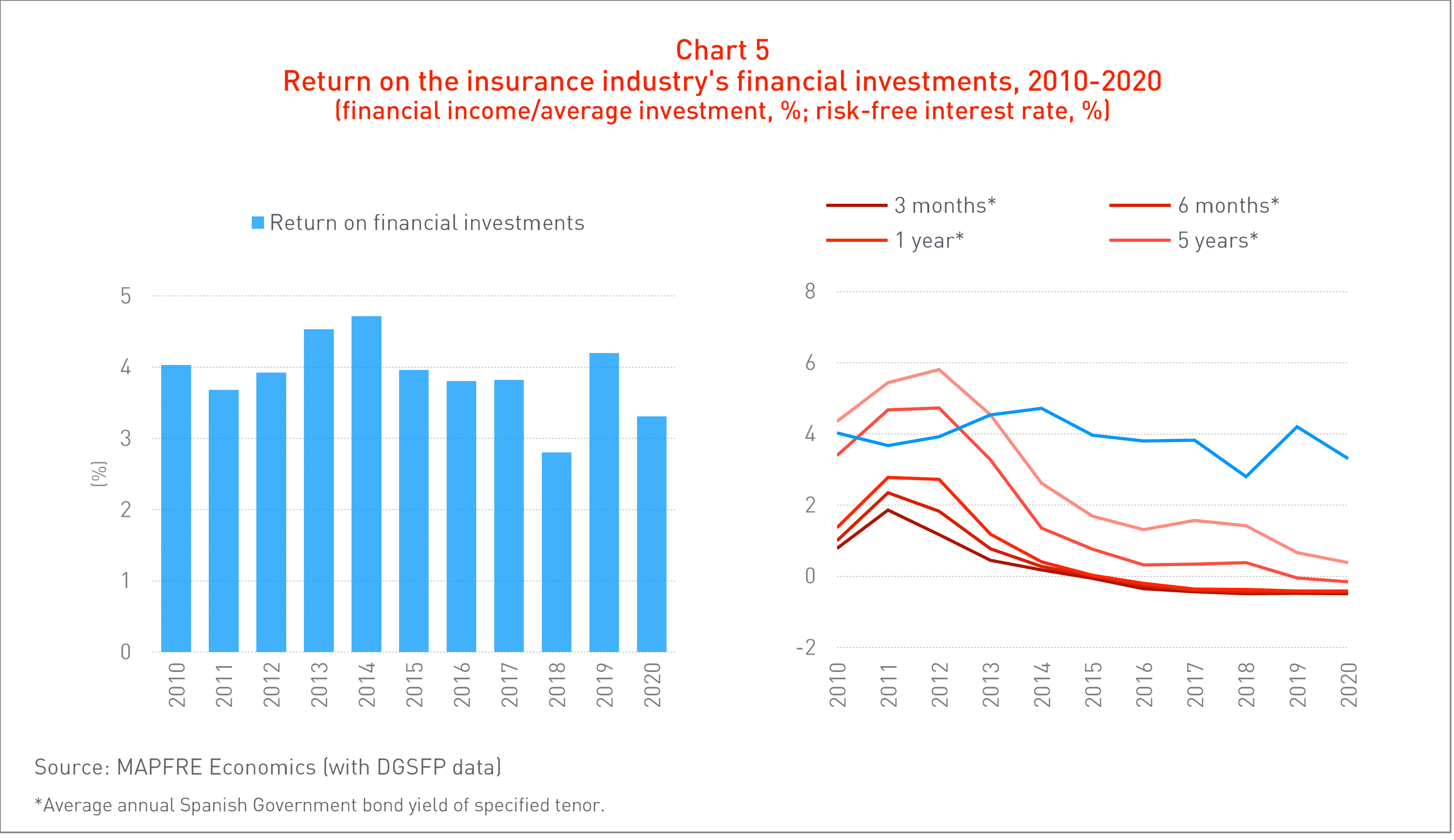

Efforts to improve technical profitability in recent years are allowing the Spanish insurance sector to partially offset the loss of returns on investment portfolios due to the low-interest-rate environment (see Chart 5). Total investment by Spanish insurance companies amounted to 335.61 billion euros in 2020, representing a 1.9% increase compared to 2019.

Considering the relative return on equity (ROE) and return on assets (ROA), 2020 saw an improvement in relative terms. Thus, the industry performed positively in terms of profitability, breaking the downward trend of the previous two years, with an ROE of 12% (10.9% in 2019) and an ROA of 1.6% (1.4% in 2019). Overall, the Spanish insurance sector produced a result of 5.8 billion euros in 2020, a 16.6% increase over the previous year.

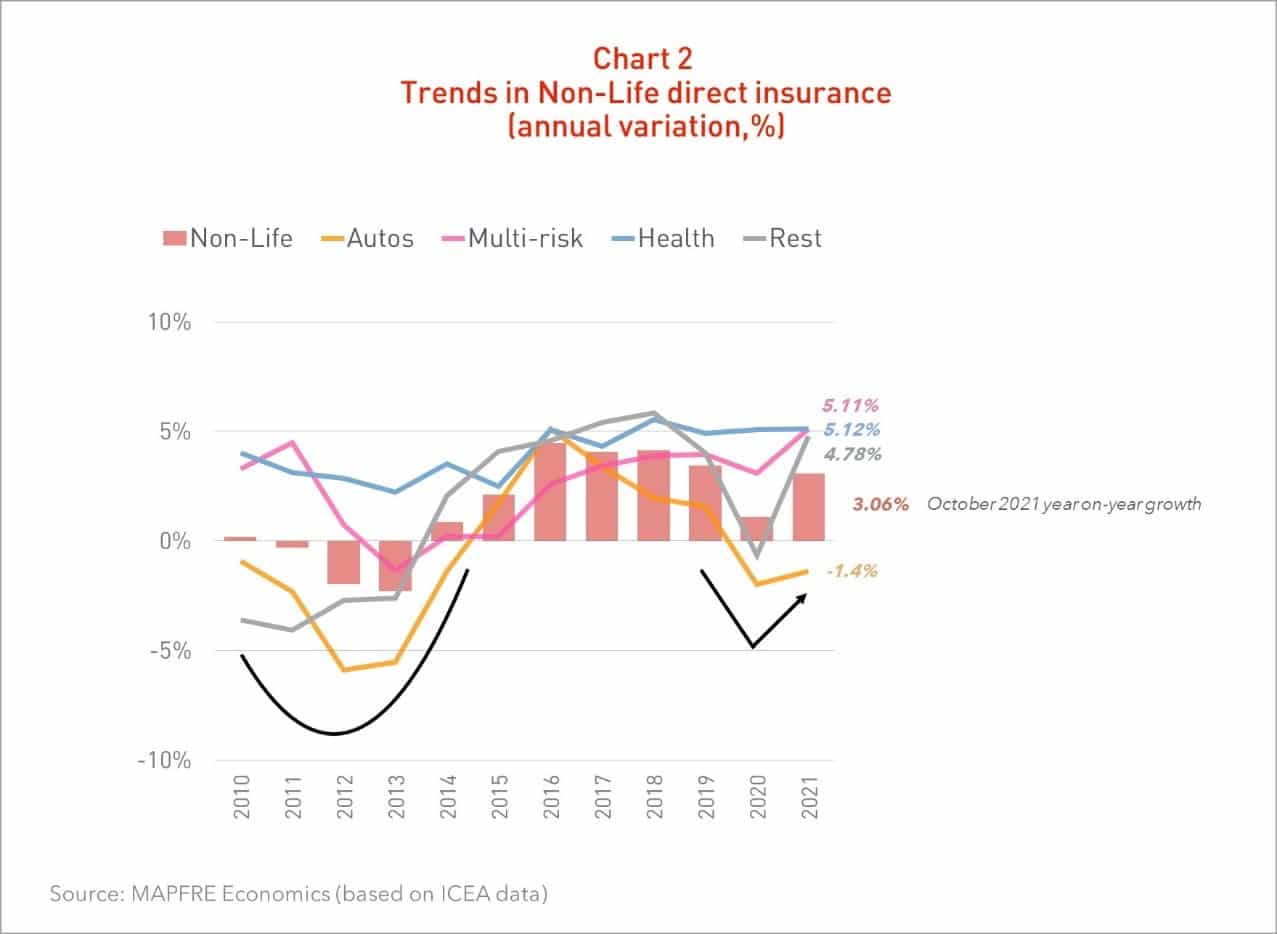

In terms of the penetration, density and depth indexes, 2020 was a unique year due to the severe economic recession. In this environment, the insurance business declined less than the overall economy, and the downturn mainly affected the Life business. In any case, these indicators are still below the average of the 15 main EU economies, although the difference in penetration level in the Non-Life business was irrelevant and almost non-existent (see Chart 6).