Global economic outlook (Q4 2023)

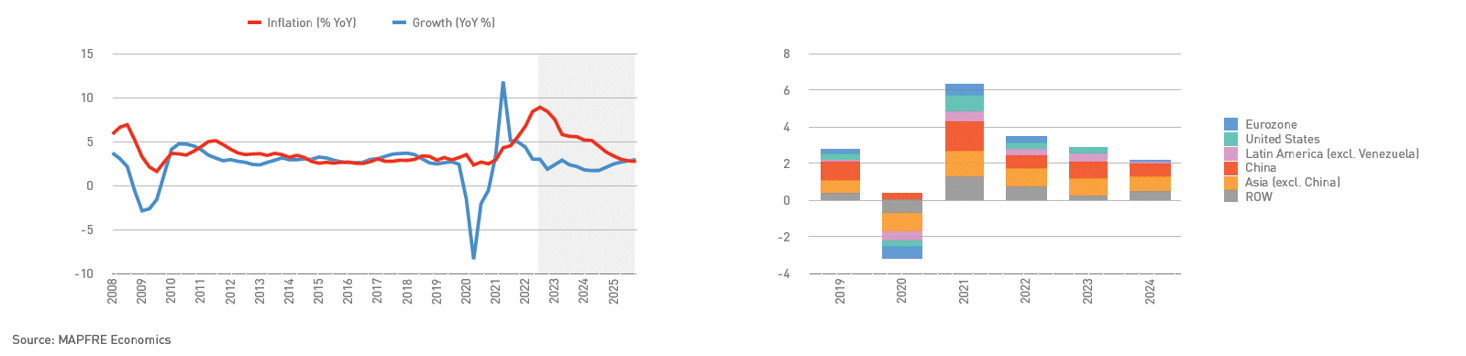

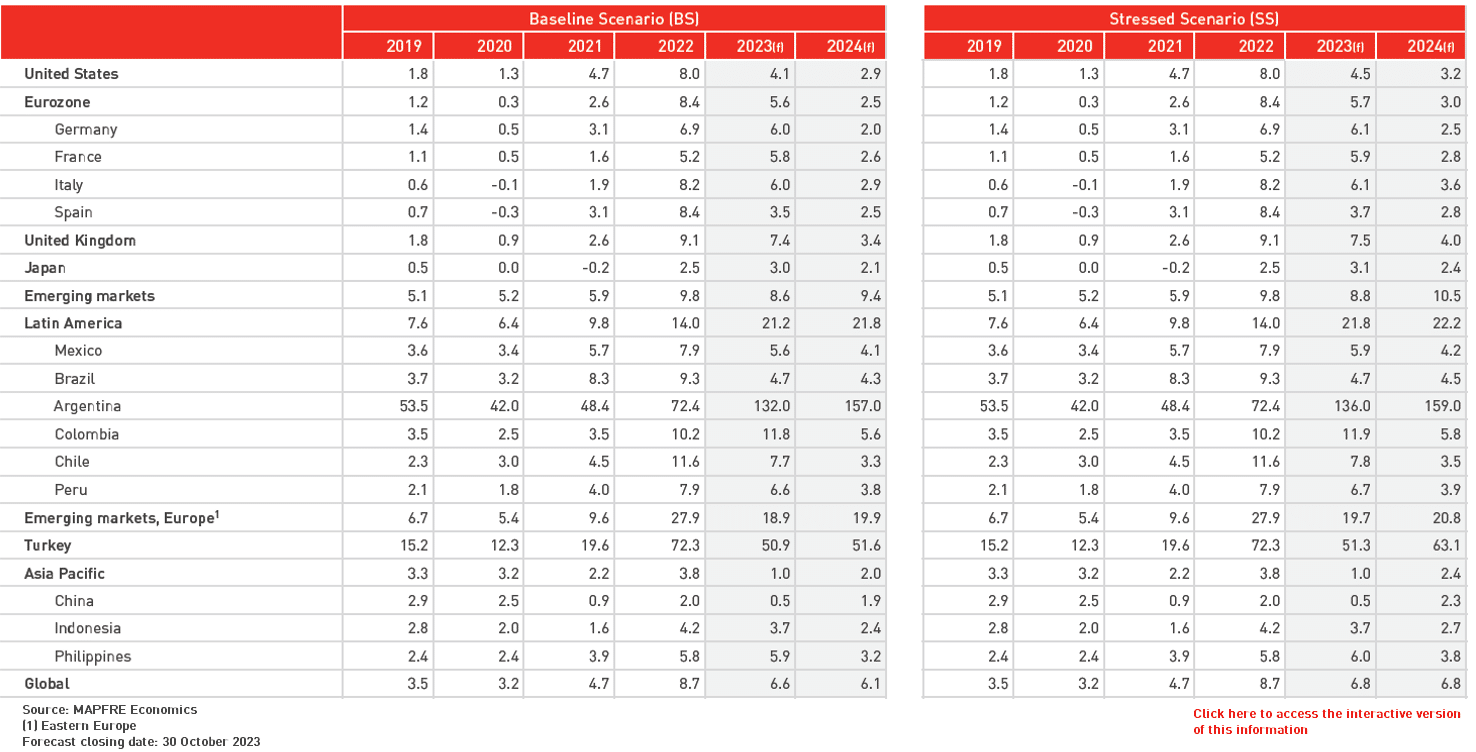

Inflation has continued to trend lower, though the reduction has not yet reached the desired level, both in terms of the current rate and expected inflation. Both of these measures exceed the targets of various central banks. This confirms that economic policy still needs to act as a counterweight to a multitude of both circumstantial and structural factors that arose from the pandemic, such as the energy transition, deglobalization, labor shortages, resource protectionism, and the greater role of fiscal policy.

Also, in terms of economic activity, the probability of a demand shock remains significant due to the high levels of monetary tightening, as well as uncertainty regarding the actual impact of the lags in transmitting monetary policy. Manufacturing is expected to remain depressed, as industrial activity is still far from stable, and there is less ability to pass on price increases to end customers. The service industry is pointing downward recently, losing momentum and moving toward greater synchrony with manufacturing.

As for monetary policy, the determination to reach the cyclical peak remains imprecise and inconclusive due to uncertainty with respect to the aforementioned variables. Added to this is the potential crisis on the energy side that might arise from an escalation of the conflict in the Middle East.

In conclusion, the outlook for the global economy, looking ahead to 2024, continues to point to stagflationary dynamics, with monetary policy sustaining the tightening of financial conditions, growth slowing and inflation facing a more prolonged and sustainable phase of easing, although still far from target levels. This scenario is compounded by a series of growing regional divergences, different cyclical moments and different ways of applying the economic tools at hand, thus exposing a vulnerability gap and very unequal margins for action. All this is in the context of the uncertainty, persistent or transitory, surrounding a geopolitical situation that is casting a shadow over the outcome of the possible scenarios.

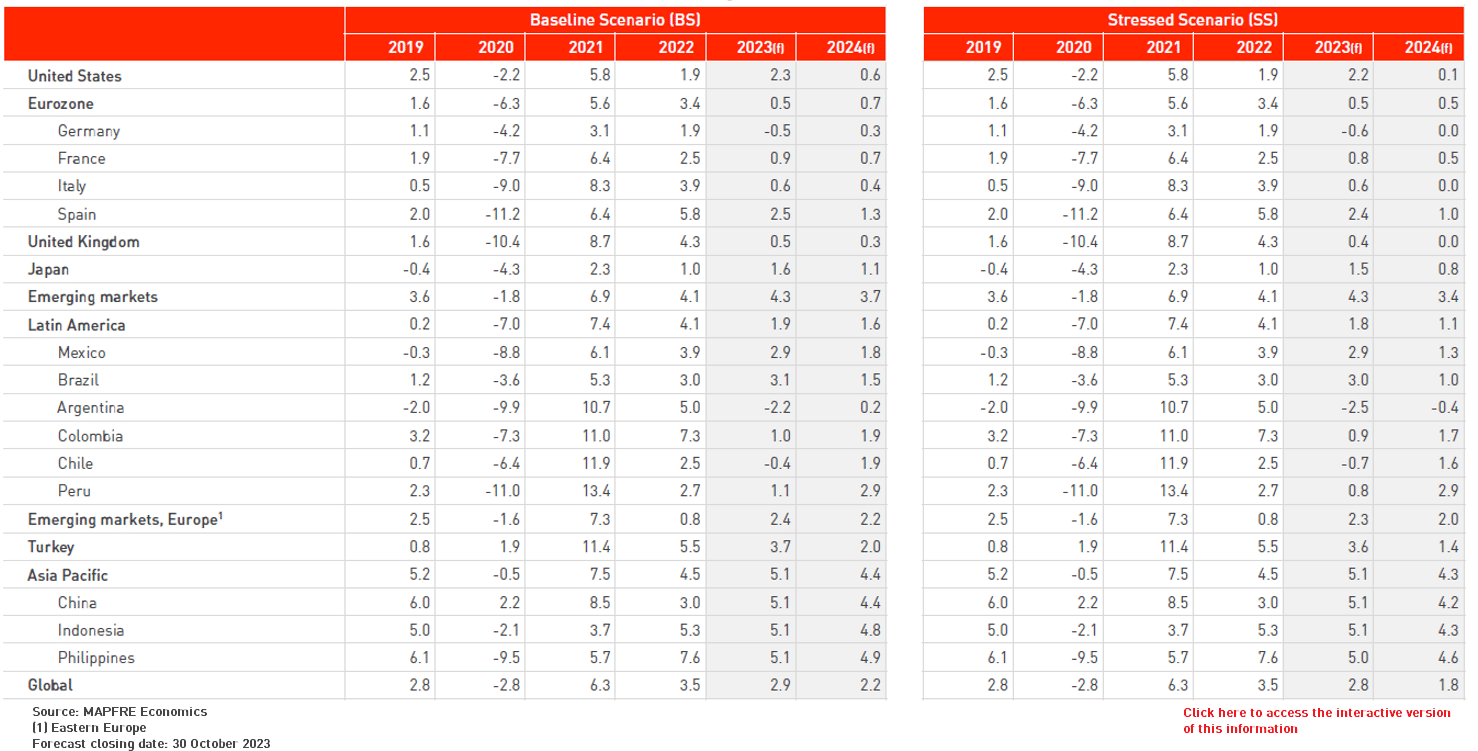

With respect to the forecasts, both for the remainder of 2023 and 2024, the baseline scenario envisaged in the report shows: (i) below-potential growth, with a cyclical downturn later than what was suggested in previous reports and more abrupt for next year; (ii) inflation subject to more sustainable rates, allowing the gradual recovery of real salaries; and (iii) a monetary policy that would remain at current levels, at least until the second half of 2024 in developed countries. It would continue to gradually relax in emerging countries, while taking into account the internal balances between economic activity and prices.

Conversely, the stressed scenario, which is a more pessimistic alternative, poses a harsher outlook of stagflation, with implications both for economic activity and price dynamics. In this scenario, fiscal policy is subject to tighter financial conditions, although remaining in neutral territory, with no signs of fiscal protection mechanisms being reactivated. Monetary policy would remain tighter on a more prolonged basis, with an additional interest rate hike by the Federal Reserve, but not by the European Central Bank. Meanwhile, monetary easing is delayed until the end of 2024 and early 2025. This scenario does not envisage an additional level of tightening in monetary policies in emerging markets, but these markets would undertake an easing process that would be lengthier, and which would lag behind by one quarter.

Table 2. Baseline and stressed scenarios: inflation

(% YoY, average)

The complete analysis of economic and industry perspectives can be found in the report 2023 Economic and Industry Outlook: Fourth-Quarter Perspectives , prepared by MAPFRE Economics, which is available at the following link: