Global Economic Outlook (4Q-2020)

Author: MAPFRE Economics

Summary of the report’s conclusions:

MAPFRE Economics

2020 Economic and Industry Outlook: Fourth Quarter Perspectives

Madrid, Fundación MAPFRE, October 2020

After a sharp fall in the dynamics of global activity—triggered by a shock unlike any other experienced during the most recent economic crises—we now find ourselves in a phase of stabilization and temporary recovery. However, this recovery will be slow and full of downside risks that will be exacerbated by the trend of the COVID-19 pandemic. In light of this, we have revised our forecasts for economic growth in 2020, considering the positive effects of the fiscal and monetary policy measures and the relatively minor severity of health policy. Despite this, we must not ignore the resilience of the virus and the lack of preparation by many economies, which could mean that the improved dynamic of global economic activity is temporary and that this sluggishness will persist until the end of the year and into the beginning of 2021. For this reason, we have revised this year’s forecasts upward. However, this will mean a deterioration in next year’s forecasts, which will be weaker and varied at a global level.

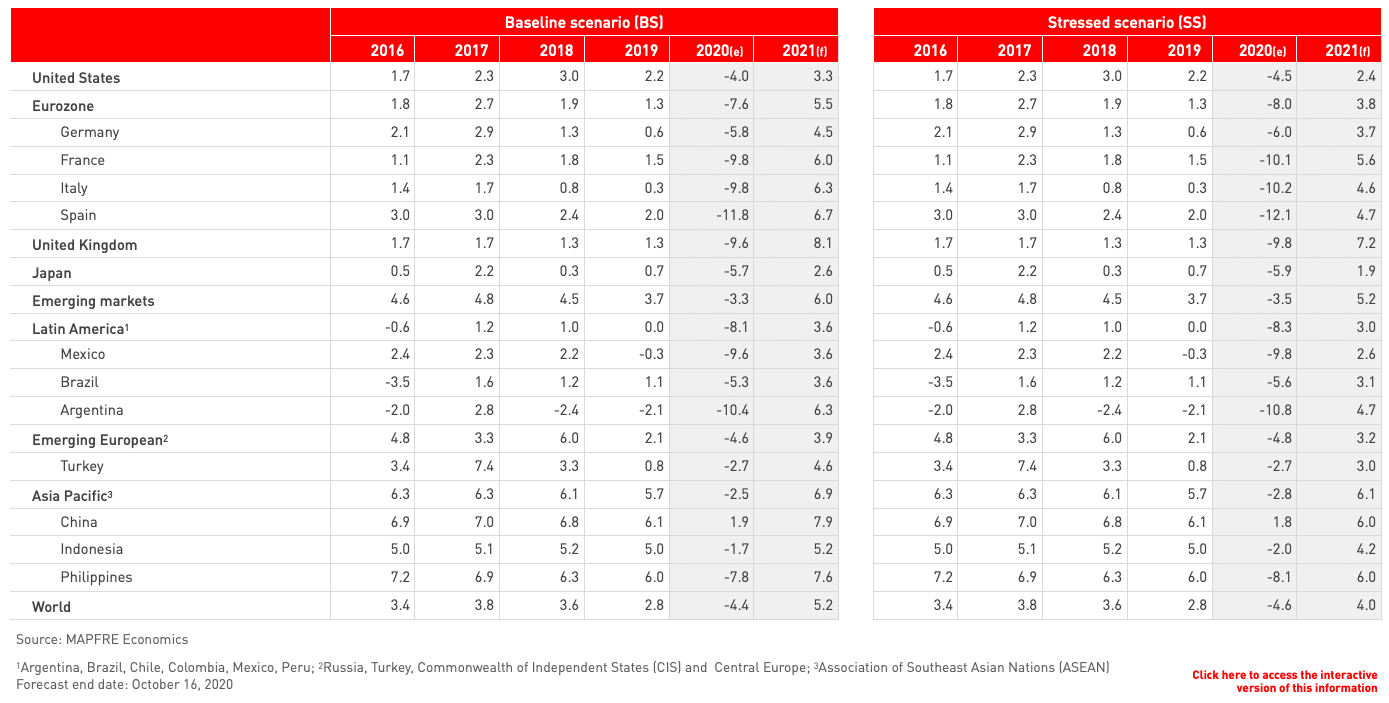

Global growth for 2020 is expected to be around -4.4% in 2020 and 5.2% in 2021. It is likely that practically all global economies (with the exception of China) will register a decline in their GDP. Meanwhile, emerging and developing countries will see their sovereign leverage reach levels rarely seen before (over 120% of GDP in 2021) due to the enormous deficit needed to alleviate the consequences of the pandemic. The fiscal space for a greater fiscal stimulus therefore seems to have depleted.

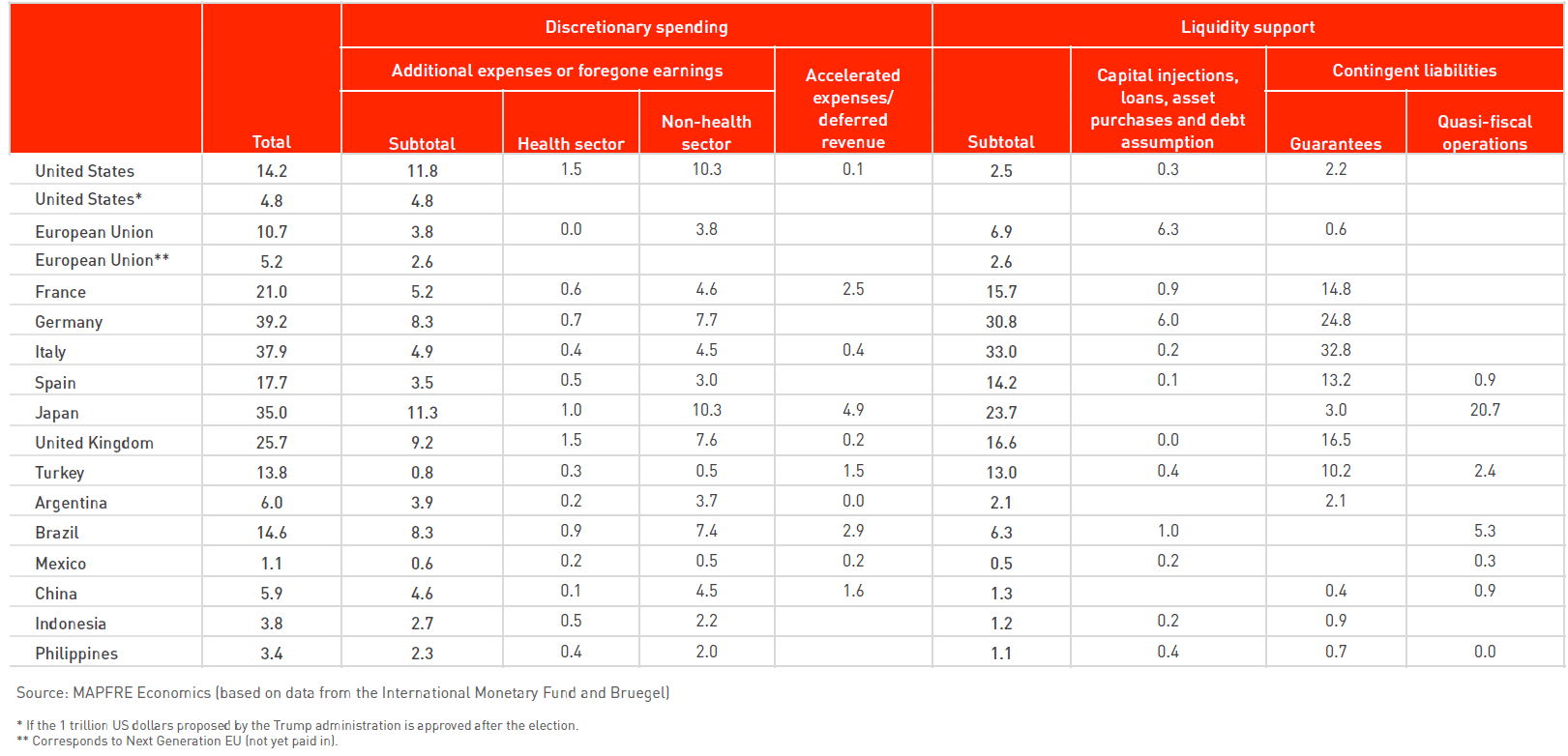

Fiscal policy has been the cornerstone in terms of helping to overcome the initial slump and prevent liquidity problems from becoming solvency problems. The table below summarizes the fiscal efforts undertaken.

Monetary policy, for its part, was the key to stabilizing markets and the real economy at the beginning of the crisis. However, efforts in this area are currently focusing on guaranteeing expectations and liquidity with the aim of containing the significant rise in global risk aversion. The latter, exacerbated by each economy’s vulnerabilities, is causing stability problems related to the balance of payments, either due to increased sovereign deficits or significant correction in portfolio flows, which has immediate effects on the current account, exchange rate and reserves of many emerging economies.

In short, the world is facing an unprecedented crisis, which is enormously challenging to overcome. In addition, any recovery, apart from being slow and fragile, will lead us to a new normal with its own challenges that societies must learn to face.

Using identical rationales to define our central and stressed scenarios, we have reviewed and adjusted our forecasts from six months ago, substantially improving the outlook for 2020 and adjusting that of 2021. Although the outlook is not as negative as we set out six months ago, it is not free from risks that would lead to a strong downward bias. Therefore, in the light of the second wave, we currently favor a more stressed scenario over a central one. These are the GDP forecasts we are currently managing.

The full analysis can be found in the 2020 Economic and Industry Outlook: Fourth Quarter Perspectives report prepared by MAPFRE Economics, which is available at the following link: