Industry outlook for the insurance market (Q2 2022)

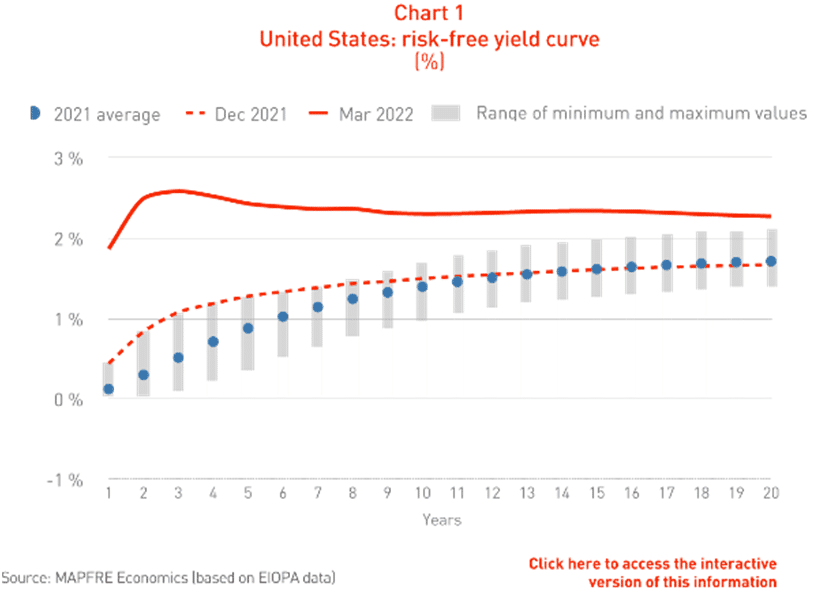

In this regard, at its April meeting, the European Central Bank, while deciding to maintain short-term interest rates at current levels (0% for the main refinancing operations and -0.5% for the deposit facility), entered into a context of a more accelerated than expected reduction of net asset purchase programs, signaling possible interest rate hikes that could occur later this year. Thus, the increase in the volume of net purchases of sovereign and corporate bonds is expected to end between July and September, with rate hikes starting “some time after” the end of the net purchase program and would in any case be gradual, depending on the data to be produced.

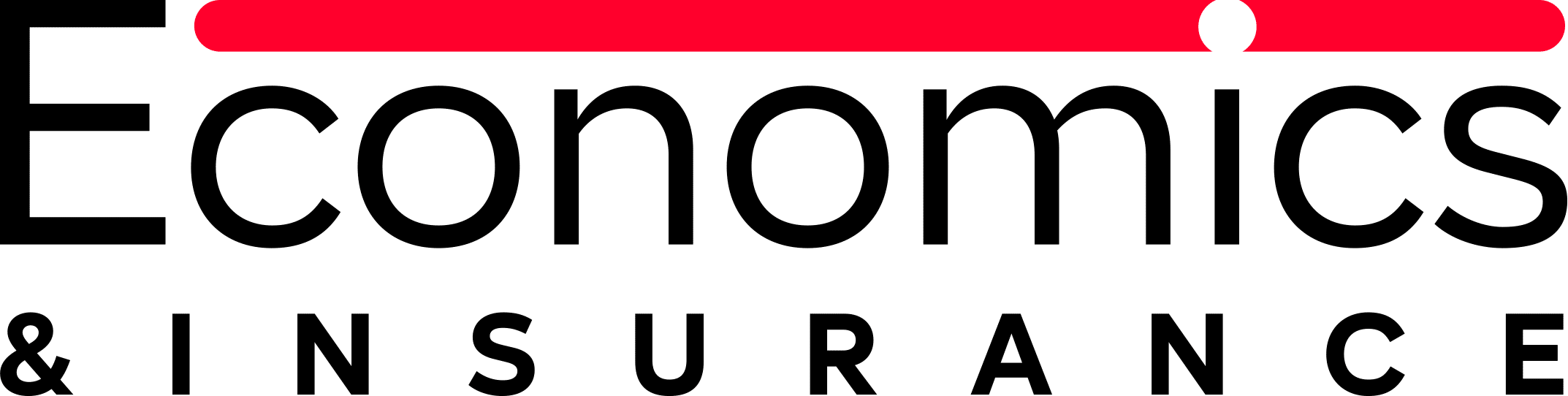

For its part, the US Federal Reserve raised interest rates at its last meeting in May by 50 basis points to leave them in the range of 0.75%-1%. It is expected to continue to raise them in the coming meetings and will also begin a process of reducing its balance sheet by an amount that will increase to 95 billion dollars per month in September in a process known as “quantitative tightening” or QT (monthly reduction of 60 billion sovereign bonds and 35 billion corporate bonds backed by mortgages that the Federal Reserve holds on its balance sheet).

On the other hand, the outlook for Life insurance in which the policyholder assumes the investment risk has become more complicated as a result of the setbacks and the high volatility of the stock markets, which make their commercialization more difficult. This will compel insurance companies to adapt their products to a new environment with corrections and greater volatility in equities and in which risk-free interest rates and risk premiums in fixed income are rising in the face of economic uncertainty and the withdrawal of monetary stimuli by central banks, with spreads more closely aligned to the credit risk of the issues, so that the bond market (sovereign and corporate) is expected to become more important.

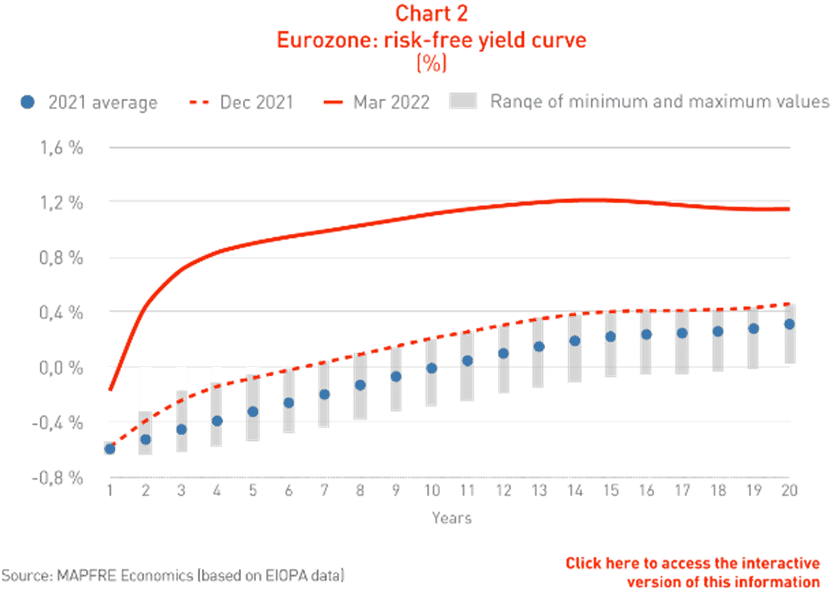

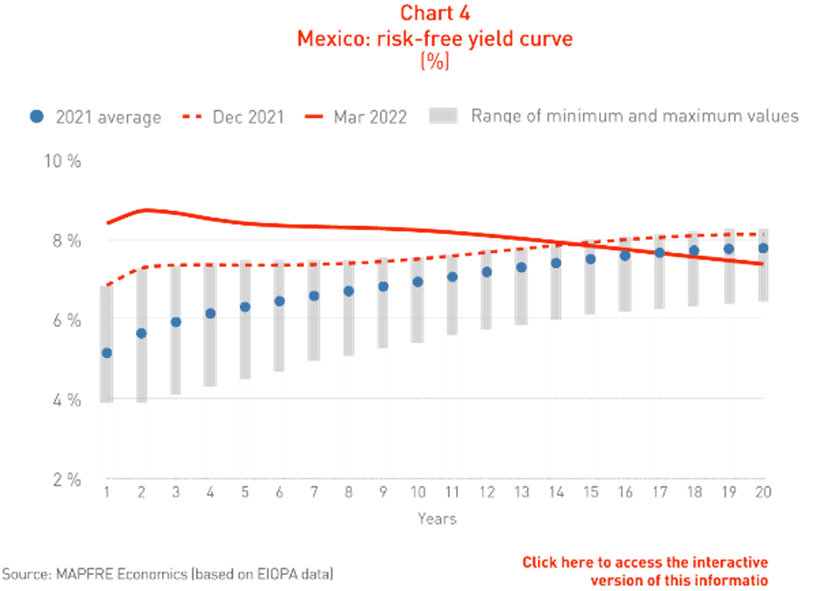

On the other hand, most emerging countries continue to deepen their restrictive monetary policy with sharp interest rate hikes in their fight against inflation, as is the case of Brazil and Mexico (see Charts 3 and 4). These rate hikes together with the new geopolitical context are leading to downward revisions in their economic growth expectations, which will be transferred to the development of the insurance business, although they are generating a more favorable interest rate environment for the development of the Life savings and traditional annuity business by being able to market products that offer higher yields to protect against the loss of purchasing power caused by inflation. However, the erosion of household disposable income brought about by the inflationary process may reduce the demand for this type of product.

In Spain, there has been a substantial downgrade in economic growth expectations for 2022 by 1.3 percentage points to 4.2% compared to 4.5% in 2021. This implies that the Spanish economy will suffer a slowdown in growth and will not reach its pre-pandemic level until 2023. The pandemic is evolving favorably, having a positive impact on important sectors for the Spanish economy such as tourism, however, the increase in energy and food prices has led to a sharp rise in inflation. Private consumption and investment (with the help of European funds) continue to recover, but lose momentum due to the high uncertainty coupled with the loss of household purchasing power and the fall in corporate margins as a result of inflation, which may detract from the dynamism of the insurance market’s business development and erode its profitability, increasing the pressure on insurance prices. The shortage of supplies continues to slow down production levels in the automotive sector, weighing down exports and new vehicle registrations, a situation that has worsened as a result of the invasion of Ukraine, thus the auto insurance business will continue to be affected by this situation, and uncertainty has risen as to its possible recovery in the coming months.

The business for life insurance linked to savings in Spain will continue to be marked by the low interest rate environment, although the situation is beginning to show a slight improvement due to the change in the monetary policy stance of the European Central Bank, which is raising the interest rate curve of the Spanish sovereign bond market, leaving negative territory in all maturities over one year and beginning to offer a certain positive term premium. However, nominal interest rates continue at levels below inflation, creating an environment of negative real interest rates, which means that premiums for traditional life insurance savings and annuities are expected to remain far from pre-crisis levels. Equities, which had been an alternative to protect against the low interest rate environment and the upturn in inflation, have suffered falls and a spike in volatility as a result of the war in Ukraine, complicating the outlook for the development of life insurance products in which the policyholder assumes the investment risk.

Full analysis of the economic and industry perspectives with additional information and interactive charts on the Eurozone, Germany, Italy, Spain, the United Kingdom, the United States, Brazil, Mexico, Argentina, Turkey, Japan, China and the Philippines can be found in the report entitled 2022 Economic and industry outlook: second quarter perspectives, compiled by MAPFRE Economics and available at the following link: