Composition of insurance companies’ investment portfolios in the wake of COVID-19

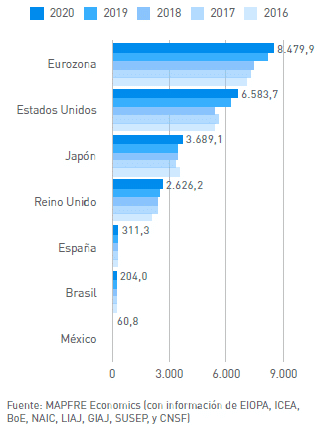

Chart 1

Selected markets: investments managed by the insurance industry, 2016 – 2020 (billions of euros)

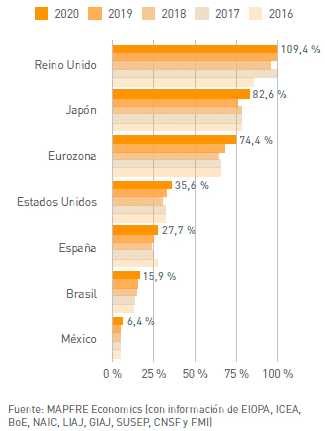

Chart 2

Selected markets: investments managed by the insurance industry as a share of GDP, 2016 – 2020 (% of GDP )

During the two years of the pandemic, markets were driven by different factors. On the one hand, central banks expanded money issuance to spur purchasing of government bonds and certain corporate bonds that kept market interest rates low. On the other hand, these central bank issues, together with government stimulus programs put in place to mitigate disruptions in economies, have found their way into the real economy and other assets as well. This circumstance has been reflected in the dissonance between the strong valuation of stock markets and the real economy, which contracted in many countries due to the mobility restrictions imposed. This massive flow of money has also fueled the rise in value of many other assets (not just real estate) and intensified the already “emerging” inflation.

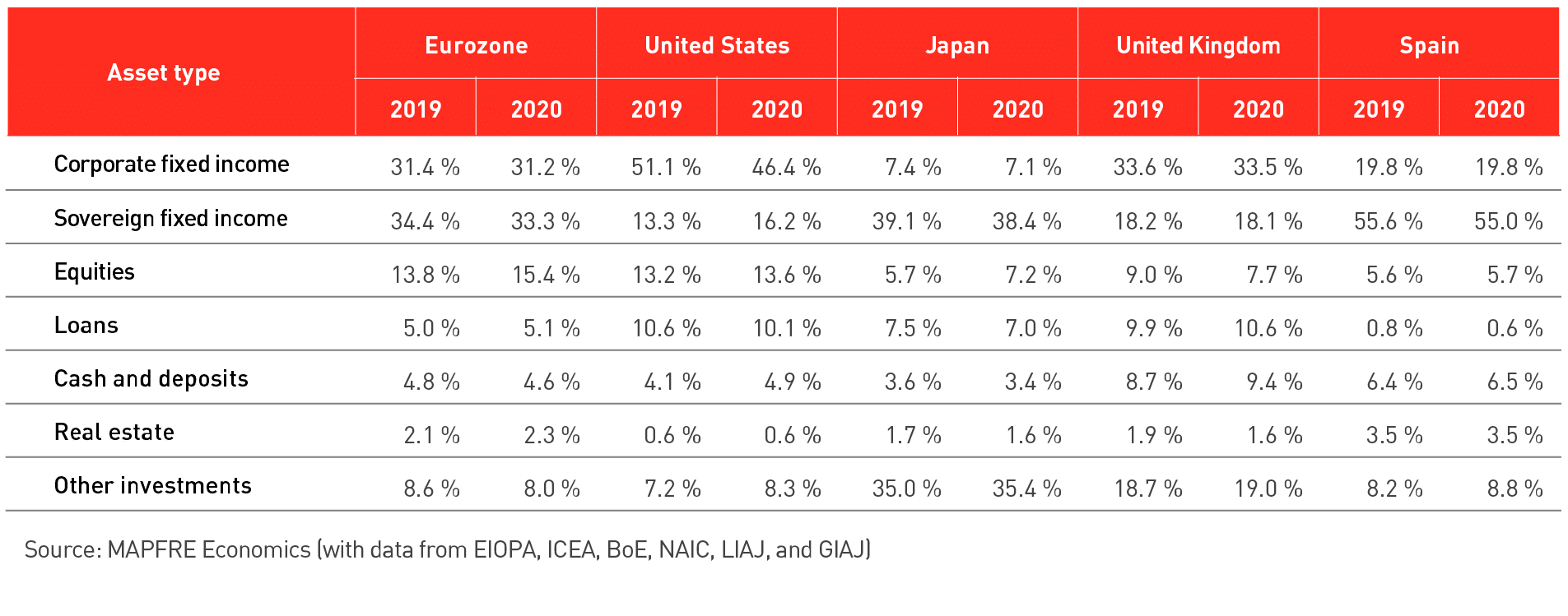

Against this backdrop, a comparative analysis of the major global insurance markets shows the main items in their investment portfolios for different economies where (see Table 1), broadly speaking, the high level of concentration of investments in fixed income (corporate and sovereign) is of note. This predominance can be explained to a large extent by the fact that the insurance business model involves the need to implement liability-driven investment strategies in order to achieve an appropriate match in terms of maturity and interest rates between recognized liabilities and the investment instruments that back them up.

Table 1

Structural breakdown of traditional business investment portfolios, 2019 – 2020 (%)

Over the last decade, the global environment has been characterized by low growth and low inflation rates, in line with a secular trend of declining potential growth, lower productivity, and, consequently, a low interest rate environment whose persistence has led to a greater risk appetite in search of higher returns, albeit under a selection process supported by more evolved regulation.

The year 2020 was marked by a continuation of this trend, accelerated by the measures taken by the main central banks worldwide to help solve the problems of liquidity shortages in bond markets, to address the widening of credit spreads, and, more generally, to ensure the proper functioning of markets, allowing these markets to continue to function properly. Thus, issuing companies and states could continue to place their issues in order to gain access to the liquidity needed to deal with the situation they faced and, most importantly, to be able to refinance their debts at a reasonable cost. The more recent environment, characterized by higher and persistent inflation rates, reflects a shift in bias toward less accommodative financial conditions, both in terms of a reduced dampening effect of central bank balance sheets and presumably less credit easing due to rising interest rates. In this context, the conservative profile of the investments on insurance companies’ balance sheets as well as their credit quality is particularly relevant since, despite the pressures on investment returns and the greater diversity of assets in the portfolios, the quality of investments has been maintained and even improved within an appropriate scale perimeter and with a tendency to accumulate tranches of higher quality, as shown by the European evolutionary composition (see Graph 3).

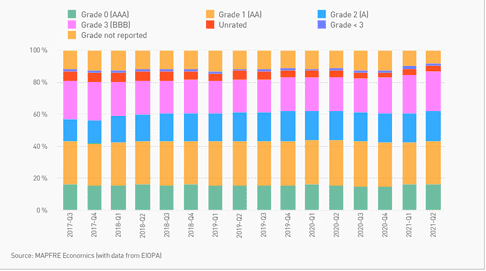

Chart 3

Credit quality of the bond portfolio (%)